FINDING a compatible flatmate is incredibly important when you’re living in a houseshare – but how do you know whether someone really is a perfect match?

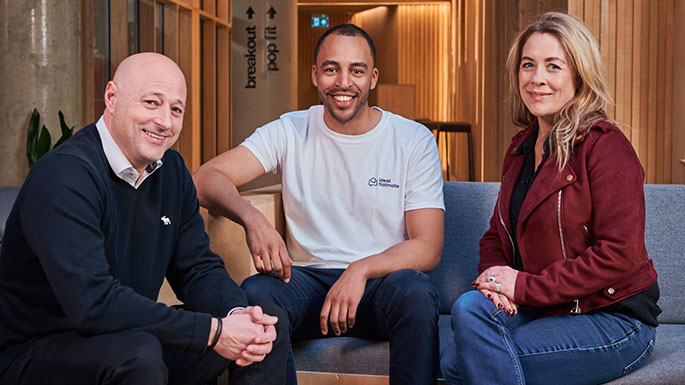

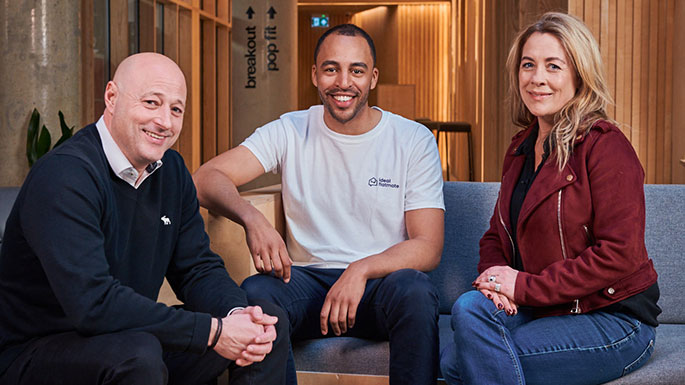

Step forward Rob Imonikhe and Tom Gatzen, co-founders of Ideal Flatmate, an online service that does all the hard work of household matchmaking for you.

To see how it works, we set Rob and Tom up with property queen Sarah Beeny and accountancy guru Bobby Lane as they prepared them for a big date – April 1, when the government’s Making Tax Digital initiative comes into force…

Everybody has, or knows, a nightmare houseshare story. Certainly Rob and Tom have heard their fair share of them. From mouldy fridges to questionable personal hygiene and unwelcome cupboard raids, they know exactly what drives housemates mad – and how to avoid the worst of the pitfalls.

Indeed, it’s this knowledge that has informed the innovative algorithm-led quiz that is a key element of their service, which aims to match potential co-habitees. Using questions based around sociability, tidiness and general attitudes – Do you order your spices on the shelf? Is it acceptable to bring friends back for drinks after the pub closes? – it helps you sort the party animals from the home birds.

Rob, 28, and Tom, 30, who were flatmates at university, are clearly filling a need, as the service has proved a massive success. In the past year, the number of properties added to their website has shot from 300 to 8,000 – and they now boast 300,000 unique users a month, with a client base that’s expanded out from London to other cities across the UK.

Sarah Beeny, who launched matchmaking website MySingleFriend in the early 2000s, says Ideal Flatmate is a genius idea – one that, like all the best businesses, is based on a simple but effective premise.

“I’ve never flatshared as I met my husband at 19, but I know it can be a nightmare, so anything that helps you find your ideal match has to be a good idea,” she says.

“So much about flatsharing would drive me mad. I run an efficient system at home, so we never run out of the basics. I couldn’t live in an environment where you go away for the weekend and come home to find there’s no loo roll left. I’m organised: before I go to bed I put the dishwasher on and wipe down the surfaces, so that when I come down the next morning the day starts off well. Living with a messy flatmate – no, I’d hate it.”

She’s not alone. After running their business idea past enthusiastic friends and family, who agreed they had hit on a gap in the market, Rob and Tom googled “freelance web developers” and found some talented collaborators, including two Cambridge professors, to design their algorithm and build their concept.

Backing you: Quickbooks insider tips

1. Stay on top of the numbers

It’s tempting to focus on the exciting parts of launching and running a business, but don’t neglect the financial side – especially when online accounting software can automate bookkeeping tasks.

2. Watch the cashflow

Cashflow management can make or break a business. Luckily, you don’t need to be a financial whizz to understand where your money is going. Look for accounting software that sorts your data and automatically produces a real-time dashboard of your cashflow. Use it to help make sound decisions for the future.

3. Spend time wisely

Did you know that online accounting software can save you up to ten hours a month? That’s extra time to create new products or services. The right tools can remove the headache from financial management and let you focus on what you enjoy most.

“We understood from day one that having the right people to help build the concept was key,” Rob says, impressing Sarah by how quickly they grasped one of her key business rules. She adds, “Possessing the self-awareness to say I’m good at this but not so good at that is vital when it comes to running a successful business. Nobody can be expert in everything, and recognising that and delegating is an important skill.”

It’s an equally important lesson when it comes to bookkeeping. When Ideal Flatmate was launched, Tom bought an “idiot’s guide” to accounting and taught himself the basics. Then, as the company grew, an accountant friend crunched their numbers every month.

Now Rob and Tom have big expansion plans, increasing their presence in the UK before looking to Europe in 2020. With this in mind, Bobby says it’s time to upgrade their accounting software, as although they have had no problems so far, expanding will make their finances much more complex.

“They need systems that are fit for purpose as the business grows,” he explains. “Trying to reduce the use of spreadsheets and manual input has to be a focus, otherwise future profits could be swallowed up by inefficient processes.

Using a system such as QuickBooks would allow them to handle key business processes, including invoicing, expenses and financial planning, in a much easier and time effective way.”

Bobby also advises the pair to be mindful of new legislation coming into force on April 1 as part of the government’s Making Tax Digital initiative. All VAT-registered businesses with a taxable turnover above £85,000 must keep digital records and file VAT returns digitally using compliant software, such as QuickBooks.

“We were thinking of waiting until the company had grown before upgrading,” admits Rob, “but Sarah and Bobby’s advice was to get a really effective accountancy set-up in place now, so we are ready as we expand. It makes sense and it’s good advice. It will free up more time that we can use to focus on pushing up our visitor numbers and giving users an even better experience.”

That’s the business sorted – so what about the home front? Have Rob and Tom found their ideal flatmates?

“I live with my girlfriend,” Tom says. “We did the Ideal Flatmate quiz and we were only a 20 per cent match as I’m not as tidy as she’d like!”

As for Rob, he admits his own flatmate is far from perfect. “If he was a stranger he’d drive me mad, but he’s one of my dearest friends so I make allowances,” he laughs.

“I was away recently when I got a call from the police telling me the flat had been burgled as the door was open and it was really messy inside. It turned out my flatmate had forgotten to close the door on his way out and the mess was just the usual chaos.”